Network Tokenisation in QuickStream

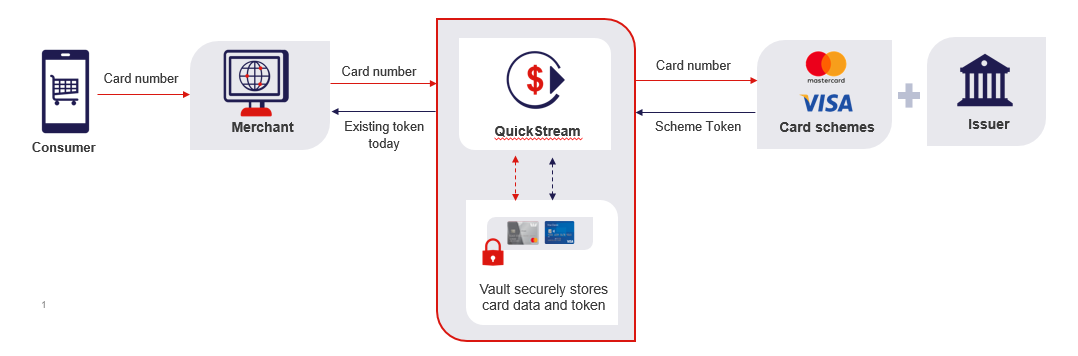

Tokenisation is the process of replacing personal data such as account details with a non-personal value (a token). This token can then be used for payment processing and transaction querying. QuickStream enables you to register and tokenise card and bank account details to securely store it in our QuickStream Vault.

The primary purpose of Tokenisation is to provide storage for card details and help your card receivables solution become PCI-DSS compliant. QuickStream, as a Tokenisation engine, has attained Level 1 PCIDSS compliance - the highest level achievable.

Both Visa and Mastercard may offer preferential interchange rates for tokenised transactions.

Enhanced functionality linking token to an underlying payment account (PAR) rather than a "card" which means transactions will be successful even in case of customer's card number being replaced (lost/stolen or other reasons).

Tokenisation at a scheme-level increases security of the PAN. Proprietary tokenisation (QuickVault) is still required for merchants to help keep their current PCI-DSS status as scheme tokens are considered "PCI-DSS sensitive" same as PAN.

Product build within QuickStream was done to minimize any changes for the merchant. Enabling Tokenisation in most cases should be a back-end enablement for their existing QuickStream facility.

How it works

A Token is a surrogate value that replaces the Primary Account Number (PAN) in the payment ecosystem. Tokenisation is the replacement of a consumer card's primary account number (PAN) with an alternative: an account token.

Network Tokenisation takes this further and replaces the PAN with a Digital Primary Account Number (DPAN). Visa and Mastercard verify the cardholder's information and provide a DPAN that can only be used by QuickStream for a single merchant. QuickStream is notified of changes to the underlying account, such as a stolen card or updated card details.

Supported channels

Tokenisation can be completed via QuickStream and can be integrated into different registration scenarios. The registration scenarios that are supported via QuickStream:

Customer-initiated Web Registration

(QuickStream REST API and/or QuickVault Web Registration)

Your customer visits a webpage where they will enter their payment details to be tokenised and saved for potential future use.

Merchant-initiated Web Registration

(QuickStream REST API and/or QuickStream Portal)

Your staff get access to a portal or web interface to enter payment details on behalf of your customers to be tokenised and saved for potential future use.

Merchant-initiated Batch Registration

(QuickVault Batch Registration)

Your staff send a batch file with customer payment details which QuickStream will tokenise in bulk and return tokens to be saved for potential future use.